ALLENTOWN, Pa. (WLVT) - As the pandemic continues, we are seeing more and more businesses closing -- and employees losing pay.

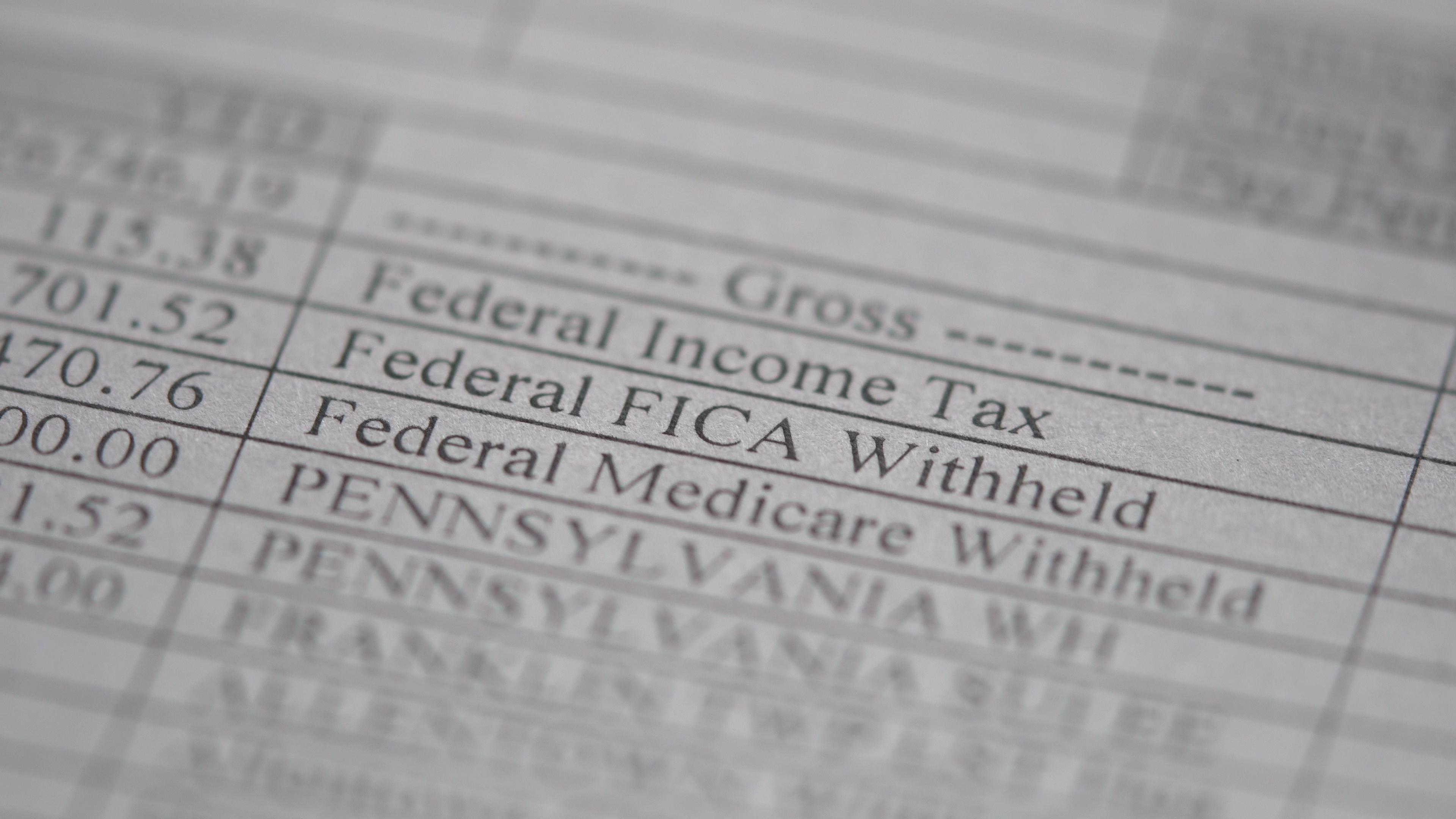

Last month President Donald Trump signed a memorandum giving businesses the opportunity to defer part of the payroll tax until January.

We spoke with Lou LeMaster, managing shareholder at Buckno, Lisicky & Co., about what it means.

"It could be a little bit dangerous because if the employees or the employers opt in to do this, they won't see that tax for the next four months, which gives them a little more spending money now. But for the first four months of 2021, from January 1 to April 30, that's going to have to be repaid."

Tony Iannelli, CEO and president of the Greater Lehigh Valley Chamber of Commerce, said locally he isn't seeing many businesses taking advantage.

"I don't hear a huge groundswell," he said. "I think the gotcha on it is that you have to pay it back. The day of reckoning is coming. It is kind of an accounting function the companies are not crazy about doing -- not that they won't for the good of the cause."