No business wants to furlough or lay off employees, or shut down. Yet as a result of the pandemic, many – or even most – businesses and organizations are facing these challenges. Some of you may have funding to cover the expected Stay At Home order period, or maybe only for a week more. Maybe you have already had to release employees, or close your doors. And naturally your employees are fearful of a loss of income and work stability.

For LVPM, many staff members are suddenly doing work outside our job descriptions, and in strange environments (see also: the sun butter-covered face of my toddler giggling while I type). Here we help you sift through the deluge of information, distractions of kids and pets and nonsense click-bait articles, to find real, specific, helpful information.

Here are different ways to understand the basics of the new law, how it affects – well, everything, and actions you can take right now. One amazing fact: these business loans are available to apply for as early as Friday, April 3.

1) What is the Paycheck Protection Program (PPP)? (Spoiler: It’s for you)

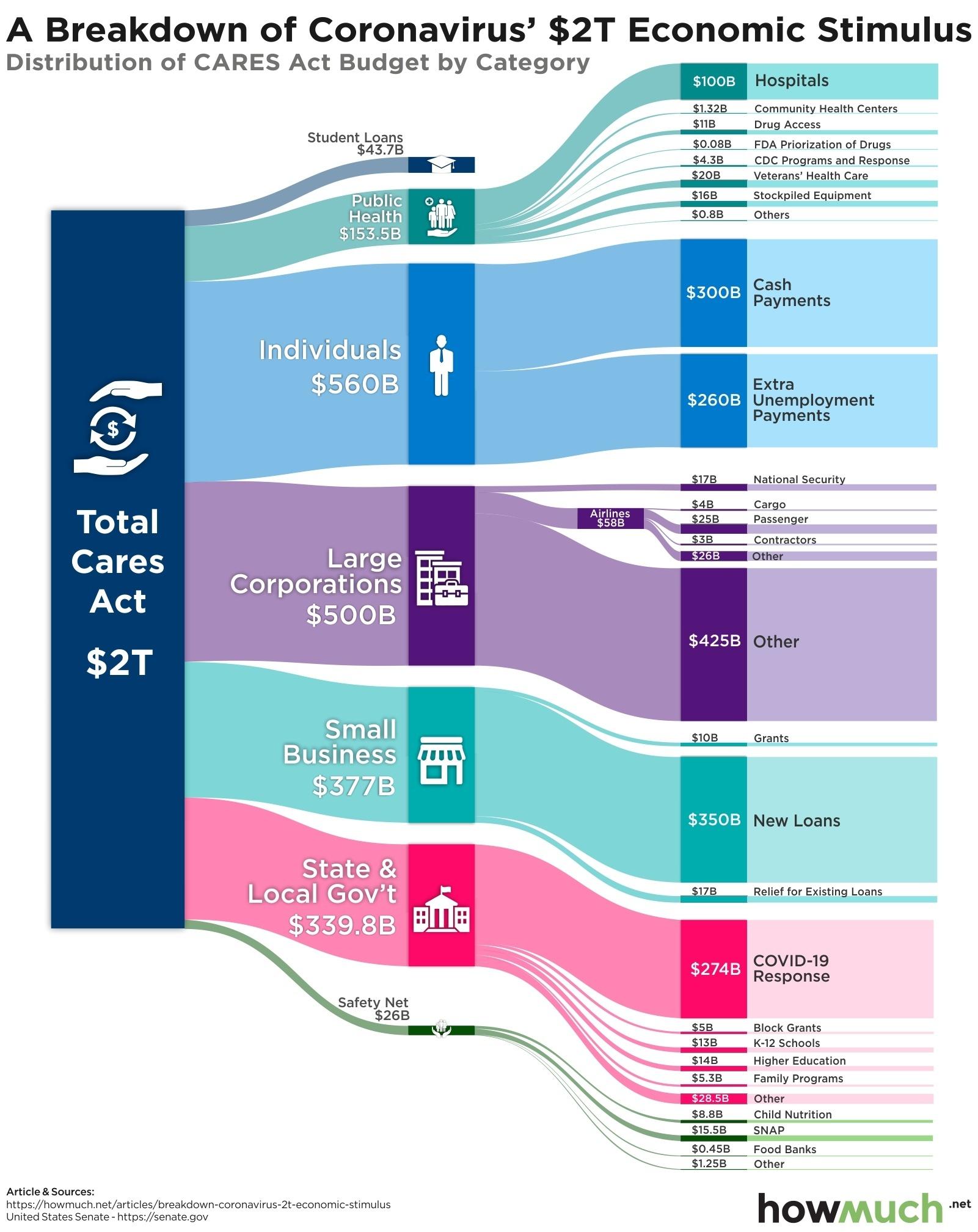

The PPP is a $349 Billion fund overseen by the Small Business Administration (SBA) earmarked to protect what drives the American economy – labor. From blue-collar workers to white-collar professional staff, every field is impacted by the pandemic, and the PPP is there to help businesses keep their employees on payroll and stay solvent. Most critically, loans will be forgiven if the business retains its employees, and uses the funds for payroll costs, interest on mortgages, rents, and utilities, and will not require collateral, capital or other typically mandatory fees to successfully apply.

Helpfully, you can apply through your existing SBA 7(a) lender, or any participating “federally insured depository institution, federally insured credit union, and Farm Credit System institution” – with more lenders likely to join as time goes on. Here is the application form.

Check out the SBA’s matching map to help you find local assistance, and this tool to search for lenders, from Scotsman Guide.

Loans are available April 3 – June 30, 2020.

2) Nonprofit Business Loans (PDF)

This is an essential tool for your organization, from the National Council of Nonprofits. There are three types of loans available, dependent on organization size and loan need – all of them are to support payroll needs, sick time and employee retention, and building costs like mortgages, rent/utilities, and debt concerns. Some loans may be available within 3 days. This excellent tool distills critical criteria by terms, type and size. Why apply now? You could protect your most important assets – your employees, and your physical space – as early as next week.

3) Location-Based Funds Available for Nonprofits

As a March 31 article from Marketwatch says, “the nonprofit sector is the third largest in the country.” It makes sense to shore up this critical component of our economy and culture. Giving Compass has curated this collection of funds for COVID19 impact support through a vetting process reflecting a priority of encompassing all work, to “Include geographic diversity and breadth” in the offerings. Beyond this, the National Center for Family Philanthropy has a geographic map with links to funds all over America – so there is a good chance you can find additional resources for your organization’s work to continue.

4) Unemployment Assistance for Employees

If you find yourself forced to let go employees – or if you’ve been let go yourself, face unemployment, or are concerned about it (let’s be honest, we all are) – make sure you know your benefits and rights as a laborer. The link above is for the U.S. Department of Labor, but check your state guidelines (PA and NJ here), because the new rules may open new doors to financial security in this unprecedented time.